The Assessor is required by the Louisiana Constitution to discover, value, and list all property subject to taxation on the assessment roll each year and then submit that roll to the Louisiana Tax Commission. Your property taxes are used to fund the majority of services that are provided to you by the local government, including funding for schools, law enforcement, roads, and public buildings.

The Assessor plays a vital role in this process. The Vernon Parish Assessor is tasked with valuing around 25,000 parcels per year. The Assessor has a responsibility to the citizens and property owners of Vernon Parish to ensure all property is assessed in a fair and equitable manner.

At the same time, the Assessor has a responsibility to ensure that the assessments are calculated according to the laws found in the Constitution of Louisiana and the Revised Statutes that are passed by the Legislature. The Louisiana Tax Commission, the state governmental oversight agency, regularly performs ratio studies to verify that our assessed values are not too low and we are following the law with respect to our assessment values.

The Assessor also:

- Tracks ownership changes

- Collects descriptions of building and property characteristics

- Accepts and approves applications from individuals and businesses eligible for exemptions and other forms of property tax relief

- Maintains maps of parcel boundaries

- Maintains the legal description of each property

- Is responsible for obtaining annual approval of all millage rates by the Louisiana Legislative Auditor.

The assessment process culminates each year with the filing of the annual tax roll which is approved by the state and then sent to the tax collectors so that they can use the information to create and send the tax bills.

The Assessor DOES NOT raise or lower your taxes. The assessor actually has no control over the amount of taxes that are collected. The assessor is only concerned with determining the correct value of your property so that everyone is treated fairly and equitably. The tax rate that determines the amount of taxes that you owe is a combination of all of the tax rates that are set each year by the parish or city agencies that provide government services to their citizens.

The Assessor DOES NOT create laws which affect property owners. The assessor simply interprets and implements the laws that are listed in the Louisiana Constitution, as adopted by the voters, and any Revised Statutes that are passed by Louisiana Legislators.

The Assessor DOES NOT collect taxes. Parish taxes are collected by the Sheriff, who by law is the Tax Collector for the Parish. Leesville, New Llano, Rosepine, and DeRidder each collect their respective taxes.

The Assessor DOES NOT seize, sell, or place liens on property for any reason.

There are 2 parts to the mathematical equation that create the amount of taxes that you owe: the assessed value of your property and the tax rate where your property is located.

Assessed Value X Tax Rate = Taxes Owed

The assessor’s duty is to make sure that the first part, the assessed value, is a fair and accurate representation of what your property is worth. To understand more about the tax rate, see How Is the Tax Rate Set. As per the Louisiana Constitution, residential property is assessed at 10% of Fair Market Value, minus any exemptions that may be applicable (to see a further explanation, see Assessed Value Ratios) found under the section What is fair market value and how does the Assessor determine it.

As an example, let’s assume a house has a Fair Market Value of $250,000, the owners qualify for homestead exemption, and the tax rate where the house is located is 130 mills. The taxes would be calculated as follows:

(Fair Market Value – Homestead Exemption) X Assessment Ratio = Assessed Value or

($250,000 - $75,000) X .10 = 17,500

Now that we have the assessed value (17,500), then we multiply this times the tax rate from our example (.130), and get the tax amount owed.

Taxable Value X Tax Rate = Taxes Owed

17,500 X .130 = $2,275 per year

If you would like an estimate of taxes on your property, feel free to use our tax calculator, however it is important to note that it will only give an estimate and we cannot guarantee that it will be 100% accurate. This is because taxing districts change their tax rate each year so the numbers are constantly changing.

Voters approve the maximum amount of taxes that can be collected by each taxing authority, such as the police jury, school board, water districts, and cities. These local government agencies with taxing authority then decide the amount of property tax that is needed each year by their department.

The total tax rate applied to your property is a combination of all of the smaller taxes that are set each year by each of these government agencies which are providing you services such as law enforcement, schools, roads, water districts, and public buildings like the library and courthouse.

Every year each, taxing authority must decide how much money they need to provide their services for the upcoming year, and then they vote to set their tax rate. This is done at a public meeting, generally in the summer or early fall. Their decisions determine if the tax rate will increase, decrease, or stay the same, so the tax rate changes a little bit each year.

On a schedule of usually 10-20 years, most taxes will expire. When they do, if the taxing authority would like to continue collecting the tax in order to continue providing their service, they must put the tax on an election ballot for the voters in the taxing district.

So, you as a voter have the ability to decide what services you would like and how much you are willing to pay for them. If you want your taxes to be lowered, you can vote not to approve future tax ballot issues, just remember that you will have to do without whatever services those taxes provide.

In Louisiana, all of your Louisiana income tax goes to the state; sales tax is split with about half going to the state and the other half remaining with local government, and ALL of your property tax remains right here in Vernon Parish. The way our government is structured, your property taxes pay for the majority of the services you receive from your local government here in your local community.

Property Taxes are seen as a very reliable form of government funding because unlike sales and income taxes, which can fluctuate greatly from year to year depending on the economy, property taxes are usually much more stable. These funds are used to build and maintain schools, pay for law enforcement and jails, the courthouse and library, roads and bridges, and water and sewer treatment to name a few.

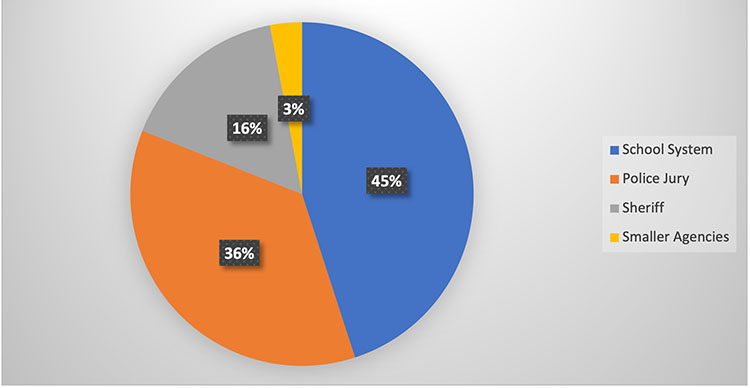

Your parish taxes are split roughly as follows:

- 45% goes to the school system,

- 36% goes to the police jury,

- 16% goes to the sheriff, and

- The remainder goes to smaller agencies such as the water districts.

Louisiana law requires assessors to reappraise, which means to revalue, every property in the parish at least once every four years. This means that every four years, the assessor must determine the appropriate fair market value of each property in the parish. The assessor then compares this value to the assessed value to see if the value has increased, decreased, or stayed the same since the last reappraisal and then makes whatever change is necessary to make the assessed value equal to fair market value.

Not necessarily. After reappraisal, the constitution provides that the taxing authorities, such as the police jury, school board, water districts, and cities, are guaranteed at least as much money as the year before so their tax rates will adjust accordingly.

For example, if the taxable value for a certain district is 10 million dollars, the tax rate is 10 mills. This would produce a tax revenue of $100,000.

Let’s assume after reappraisal that the value of the property in the district doubles and is now 20 million. It would then only require 5 mills to produce the same $100,000 of tax revenue for the district, so the tax rate is cut in half automatically. However, that district is allowed by law without a vote of the people to “roll forward” their millage rate and set it back to the original 10 mills.

This is where the tax increase from reappraisal is created. The new 20 million value would then produce $200,000 of tax revenue if the tax rate is “rolled forward” to the original 10 mills.

The constitution guarantees that taxing districts receive at least as much money as the year before. Anytime there is a decrease in assessed values because of new exemptions or any other reason, the tax rate must increase, which shifts the burden to those who remain to pay the total.

This is not to say that exemptions are good or bad but to show how they affect property owners. Here is a practical example of how the system works:

If 20 people go out to eat at a restaurant and before the bill comes, the group decides that 5 of the people shouldn’t have to pay, the bill for all 20 meals still has to be paid to the restaurant. The restaurant provided a service and they still must be paid even though the group decided that 5 shouldn’t pay. To come up with the total, the remaining 15 have to pay a little more to cover the meals of the 5.

Property tax exemptions work in the same way. In this example, property owners are the dinner guests who enjoy local services and the government agencies are the restaurant who provide these services. Whatever value is exempted from taxation in turn causes the tax rate to increase on the remainder of the taxable property enough to cover the loss in tax revenue.

Fair market value is defined as the price that a willing and knowledgeable buyer would pay a willing and knowledgeable seller, neither one having any relationship to the other or under any undue stress to buy or sell.

This means that the assessor must track transactions in the real estate market, just like private appraisers do. The assessor can then value property like similar properties that have recently sold. This is called the sales comparison approach to value.

The assessor must also closely track construction costs in order to know what the cost would be to build a new property similar to the one being assessed. The assessor would then apply the appropriate amount of depreciation to adjust for the age and wear and tear on the property. This is called the cost approach to value.

Another way to value property is to determine how much rent the property would bring in the open market. Taking the rent minus normal expenses into consideration, the assessor can then use a formula to determine what the property is worth. This method is most commonly used on income-producing properties and is called the income approach to value.

Once the value is determined for a particular property, the assessor’s job is not finished because the assessor has to find the value for every property, every year. The assessor must immediately begin gathering additional data for future years as the market is constantly changing.

Assessment Ratios

In Louisiana, residential property and land is assessed at 10% of fair market value, commercial buildings and equipment are assessed at 15% of fair market value, and public service properties, such as electric companies, major pipelines, rail road property etc., are assessed at 25%.

As a result of these different ratios which are set by law, the tax burden is shifted more heavily toward different types of property. For an example of how this works, let’s look at a home and a business which are both valued at 250,000 located in a district with a tax rate of 130 mills.

If the home is eligible for homestead exemption, the taxable value of the 250,000 home would be 175,000 after the 75,000 of homestead exemption is applied and at 10%, this would be an assessed value of 17,500.

The business is not eligible for any homestead exemption and is valued at 15%, so the assessed value of the business would be 37,500.

Since the tax rate is 130 mills, the tax for the home would be $2,275 and the tax for the business would be $4,815, even though the value of the home and business is the same.

A property’s value can change for many different reasons. The most obvious reason is that physical changes may have been made to the property such as additions and improvements. Things such as adding a carport, swimming pool, bathroom, or converting a garage to a bedroom would increase your property’s value. Your property could also suffer some type of major damage which would decrease the value of your property.

The most common cause of value change is a change in the market. The assessor does not create value. Buyers and sellers set the value by their transactions in the market place, the assessor simply has the legal and moral responsibility to study and track the trends in those transactions, then assess your property accordingly.

By late November to early December, you should receive the parish notice from the Sheriff and if you live in the city limits of Leesville, New Llano, Rosepine, or DeRidder you will receive a bill from them as well. You have until December 31 to pay them to whichever agency sent you the bill.

Even if you don’t receive a tax notice, it is your responsibility to be sure that the property taxes are paid. Many times, if you have purchased a property during the year, the notice will be sent to the seller; but as the buyer, it is your responsibility to make sure they are paid.

If your opinion of the value of your property differs from the assessor’s, by all means come to our office to discuss the matter. We will be happy to discuss it with you and try to come to an agreement.

Please come prepared to show proof that the assessor’s value is incorrect, such as a recent appraisal done by a licensed appraiser, your insurance documents showing for what value you have your property insured, or verification of the square footage of your building.

We are always willing to discuss the value of your property, but the tax rate or the amount of taxes you pay are non-negotiable. If you feel your taxes are too high, you should make your opinion known to the proper taxing authorities.

Property taxes are levied by what is called a mill, which is defined as one-tenth of one percent or .001 X the assessed value (see how are my taxes calculated). The millage rate can also be called the tax rate and is a combination of all of the individual millages for a given taxing district. The average millage rate for Vernon Parish is around 120 mills.

There are two different kind of taxes that voters are most commonly asked to approve at an election: a bond issue and a voter-approved millage.

A bond issue works like a mortgage for a government agency. If approved the agency will borrow the money for a specified term, and then the money collected each year will go to pay the note. Bond issues are sometimes referred to as a sinking fund because the amount required from the taxpayers under normal circumstances will go down each year until it is paid off. The down side is that the taxpayers are not only paying for the money borrowed, but also the interest on the loan. Bond issues are used when the agency needs all of the money upfront, like when something is being built such as a school or a fire station, or for the replacement or repair of a large ticket item such as a water system or sewer plant.

A voter-approved millage is simply a specific millage dedicated for a specific purpose for stated amount of time. These millages will produce a steady amount of money each year for the stated length of the term. There is no interest to be paid since the money is not borrowed, but a smaller amount of money comes in annually as opposed to a lump sum all at once. These taxes are generally used in situations where a steady source of income is needed for the agency, like building or infrastructure maintenance.